Meet League Data

1. What is the mission and vision of League Data?

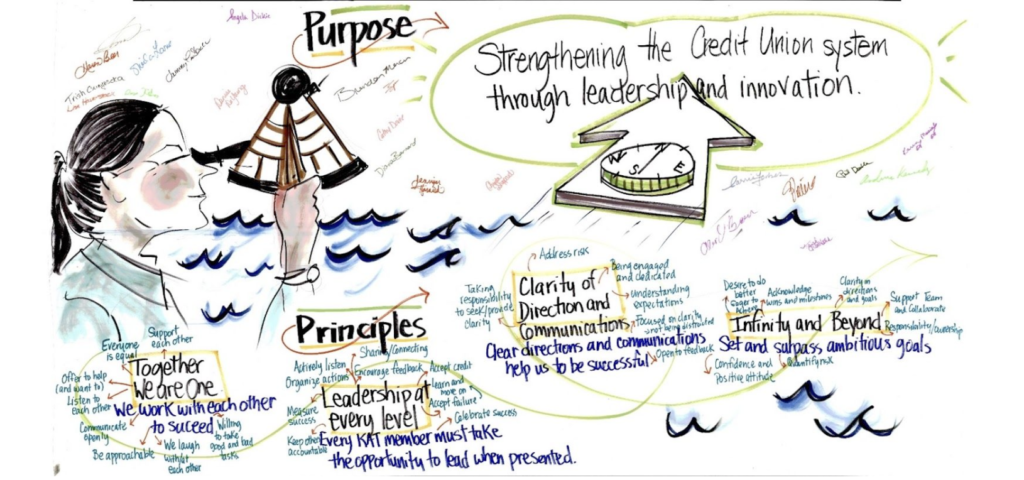

League Data has a Purpose Statement which is: “Strengthening the Credit Union System through Leadership and Innovation.” Our purpose is supported by four key principles that guide our team: ‘Together We Are One’, ‘Leadership at Every Level’, ‘Clarity of Direction and Communications’, and ‘Infinity and Beyond’. The following is a graphic with our purpose and principles:

2. Why is trustworthy digital identity critical for existing and emerging markets?

The most valuable asset our credit unions and members own within financial services is their identity and the associated data. As stewards of the data for the Atlantic credit union system, we see digital identity as one of the most critical elements needed for movements such as open banking or payments modernization. Whether it’s access to services, or protection and security, establishing a digital ID is foundational for future innovation in financial services.

3. How will digital identity transform the Canadian and global economy? How does League Data address challenges associated with this transformation?

League Data is working with Canadian partners and credit unions through digital transformation – not only of systems and networks, but the overall customer experience. The modernization of the ecosystem is also transforming the opportunities and risks available to credit unions. As a cooperator, League Data engages many entities such as vendors, governments and credit unions to help build a sustainable and secure ecosystem for Atlantic credit unions and members to shift into the digital world.

4. What role does Canada have to play as a leader in the space?

Canada has a history of building infrastructure across our nation to benefit our people, from railroads to health to banking networks. Our collective DNA has been one of collaboration and partnership which transcends pure profit, for the greater good of our people. Canada can be a leader by continuing this legacy of working partnerships to build a powerful foundation for the digital era.

5. Why did League Data join the DIACC?

We see a great opportunity to contribute our experience, technology and strategic thinking to DIACC. We are also a cooperative, and our business is built on partnerships and collaboration. DIACC is a natural fit for us in the financial services space, particularly as we look to ensure our members and credit unions can participate, compete and innovate in the digital economy.

6. What else should we know about League Data?

League Data is a non-profit, cooperative IT organization of 32 people that is the CIO for the 46 credit unions in Atlantic Canada. Since 1975, League Data has been providing solutions and expertise in financial technology through collaborative partnerships and relationships across Canada. Through our aggregated model, we provide solutions to credit unions such as core banking systems, mobile apps, network services, cybersecurity and data management.