1. What is the mission and vision of PXL Vision?

PXL Vision has one vision – A world full of trust built on verifiable digital identities to make secure, frictionless and reliable identity verification available to everyone.

2. Why is trustworthy digital identity critical for existing and emerging markets?

At PXL Vision, we believe in ensuring existing and emerging markets continue to experience strong growth that consumers, governments and businesses alike need to have 100% certainty in the trust of Canada’s digital identity ecosystem. Trust in digital identity is paramount to adoption to prevent identity fraud and protect citizens from misuse of personal data with a solid contribution to economic growth.

3. How will digital identity transform the Canadian and global economy? How does your organization address challenges associated with this transformation?

Digital identity will transform the Canadian and global economy alike by providing consumers access to services that are not currently accessible for so many. COVID has undoubtedly accelerated the need for digital IDentity. We have seen the positive impact on the economy by allowing remote non-face-to-face access for consumers to financial services, corporations, government institutions, law firms, accounting firms: and essentially any institution that previously required in-person ID verification.

Digital Transformation requires collaboration with industry experts to ensure success and scalability. At PXL Vision, we offer AI-powered identity verification tailored to your unique needs – Your business is unique. It has its own needs in security, compliance, user experience, infrastructure, business processes, and more. Our platform is uniquely flexible and adapts to your needs. It fits your existing business processes, and you can configure it to match your individual preferences.

Our customers get rid of manual processes and drive revenues, reduce process and compliance costs, open up new digital channels and boost customer conversion, preventing identity fraud and building consumer trust. Leverage the world’s most flexible identity verification platform.

4. What role does Canada have to play as a leader in this space?

Canada has an incredible opportunity through DIACC and its highly respected member participants to create a trusted framework for Digital Identity that will drive the local economy and be recognized and leveraged globally. Canada is poised to be a role model in the global development of identity ecosystems.

5. Why did your organization join the DIACC?

DIACC is creating the gold standard for Digital Identity in Canada. As the most highly respected association in the Canadian digital identity market, it makes sense that PXL Vision is part of such an organization. With PXL Vision now having a local presence in Canada, we are not only able to be a member but also to participate in the local Expert Committees to provide a global perspective from our Swiss-based experiences. PXL Vision is the technology behind the SwissID in Switzerland, and we are pleased to share best practices as Canadian provinces and the federal government digitize Canadian Government-issued IDs.

6. What else should we know about your organization?

We are a Swiss premium provider of best-in-class technology for scalable, configurable identity verification worldwide. Our AI-powered solutions help businesses of any size to reduce the cost of customer onboarding and compliance, drive revenue growth and prevent identity fraud. We strive to provide the most reliable, quickest and seamless identity verification that anyone can use anytime, anywhere.

Our journey started as a Swiss high-tech spin-off of the prestigious Swiss Federal Institute of Technology (ETH). With experience in identity verification since 2011, our company was founded by former key employees of Dacuda AG in 2017. Within three years, we became the Swiss market leader, helping companies like Swisscom, SwissID and Swisslife verify their customers securely and reliably. Since then, we have expanded internationally with a presence in Europe and North America. We are serving our customers with an international team of 70+ experts.

At PXL Vision, we provide Enterprise-grade identity verification for any business. Premium identity verification is configurable to your individual needs. Choose between our flexible Plug-and-Play solution or build your own custom experiences.

Customize the experience with PXL Pro – Integrate individual modules and features to build your own custom experience. PXL Pro provides the highest possible flexibility and allows configuration to fit your unique requirements. Build a customized experience that your customers and your business will love.

Mix and match our SDKs and APIs to build your own verification flows.

Choose between mobile vs. web, cloud vs. on-premises deployment, wholly tuned to your individual needs and fully integrated into your pre-existing business processes.

With PXL Ident®, leverage our end-to-end process, plug-and-play solution covering all phases of identity verification, including the following key areas:

– SMS/eMail verification

– Self-declaration

– Document verification

– Face verification / Liveness detection

– Address validation – PEP/SL check

– Additional document scan

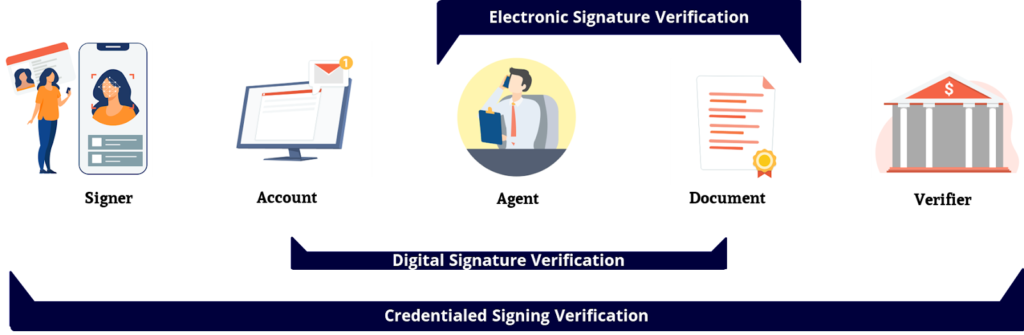

– Electronic signature

A cloud-based plug-and-play solution that gets you started immediately.

An end-to-end process with all the essentials for your identity verification and onboarding needs.

Dynamic workflow engine for tailored configuration of your verification processes. Simple integration with minimal technical knowledge is required.

Reach out to learn more about PXL Vision:

Doug Lister. VP Sales – Canada

doug.lister@pxl-vision.com

(M) 647-221-1969

www.pxl-vision.com