by Leigh Day, Business Development Manager, Canada, Yoti

In response to the COVID-19 pandemic, the team at Yoti made a pledge. We are offering free, contactless identity verification for health organizations and volunteer initiatives working on the front lines. Using our existing technologies, we have been able to achieve positive change, in light of this crisis, reaching a wider audience and assisting those in need.

Remotely and safely onboarding workers at scale

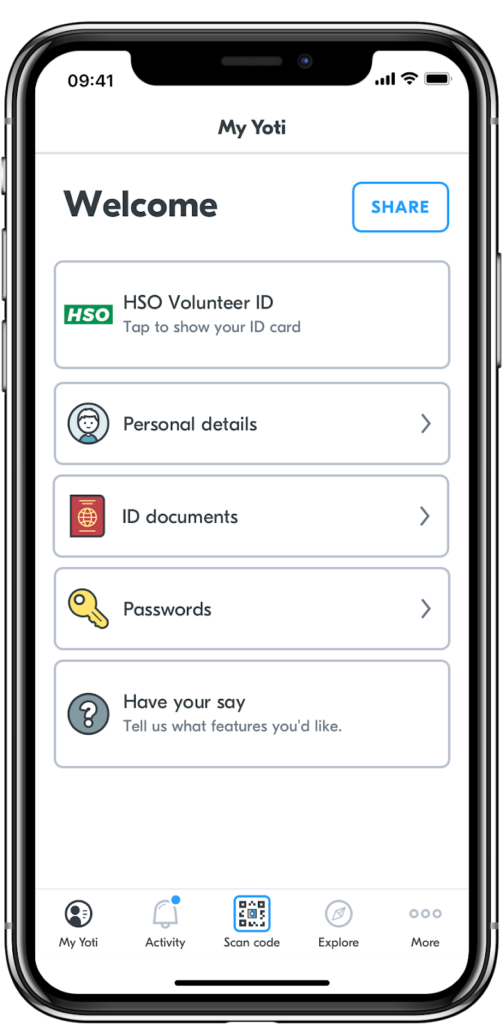

Yoti’s pledge revolves around several use cases, one being healthcare workers coming out of retirement on a volunteer basis, to aid in the COVID-19 efforts. After taking just a few minutes to download the free Yoti app and create their account, the worker can then scan a QR code on their employer’s website to remotely and securely verify their identity and be onboarded. A revocable Staff Digital ID card is then issued into their Yoti app, which they can present when reporting to a hospital to prove their identity and employment. Recruitment can be done remotely, without the need for face-to-face contact.

This solution has been deployed by the UK’s National Health Service (NHS) in April, 2020. Putting employees’ NHS ID cards directly onto their phones will help improve the onboarding of new NHS staff, as identity can be proved online and in-person within seconds, allowing these front line workers to provide the immediate medical assistance needed.

Lessening regulatory headwinds and rapid regulatory advancement

The pandemic and associated lockdowns are forcing many organizations to confront the challenge of remote identity verification in order to adapt and ensure they can provide their services effectively. We are seeing certain regulators embracing digital identity solutions, paving the way for rapid technical innovation. Businesses and regulators are realizing that digital identity solutions enable safe business continuity during this unprecedented time. This, we believe, is a step in the right direction.

For instance, the Canadian real estate industry has been largely disrupted, as real estate agents cannot hold open houses, and land title laws still require in-person identity verification plus wet ink signatures on contracts. Digital identity verification and e-signatures could be allowed, removing the requirement for notaries and clients to meet in person.The time to innovate is now, in real estate and beyond, and businesses that do not adapt quickly enough risk losing their position to those that do, and to new businesses entering the market.

email).

Emphasizing the need for true innovation, rather than manual workarounds

In response to this crisis, we are also seeing relaxation of identity verification requirements to enable business continuity. In B.C. for instance, car insurance is provided by the Insurance Corporation of British Columbia (ICBC). Insurance regulations are decades old and don’t currently contemplate digital identity solutions. To maintain social distancing, ICBC is applying temporary variance from normal in person identity verification in allowing certain transactions to be completed remotely, rather than in person, by phone or email. Instead of innovating and permanently adopting a digital ID solution for verification, this body is creating a temporary and risky work-around. A step away from innovation, this is where fraudsters can thrive.

Where solutions exist, they should be integrated, and digital ID solutions do exist. Yoti already has a diverse set of products, ranging from an electronic signing solution to enable the remote signing of documents, as well as ID verification solutions. Other technology providers offer their own innovative solutions as well, many of who are members of the DIACC.

Many of these products are already built, they just need to be adapted to the situation at hand. For digital identity adoption globally, this is a massive opportunity.

Learn More about DIACC member initiatives and identity solutions including Yoti’s within the COVID-19 Actions Directory, where we are pleased to share the actions taken to address the demands of these extraordinary circumstances.

About the Author: Leigh Day

A veteran Cyber Security Executive turned Digital ID evangelist, Leigh is helping expand Yoti’s global presence by driving new business and growth across Canada and the US, and representing Yoti within the Digital ID and Authentication Council of Canada, sitting on expert committees and contributing to the development of the Pan Canadian Trust Framework.